If there is a surprise in 2023, it will be the Fed’s tight monetary policy. At almost every Fed meeting since mid-2022, there has been speculation that the Fed will soon make changes. This turnaround opportunity is especially triggered in March 2023, when Silicon Valley Bank goes bankrupt. The Fed stopped everything and continues to raise interest rates to this day.

But practically nothing has changed. The main argument that the Fed will not be able to keep interest rates high due to the rise in the US national debt still exists. It is only a matter of time before the situation becomes intolerable and the central bank must take action to save the Ponzi pyramid that is the US national debt.

Unstoppable national debt

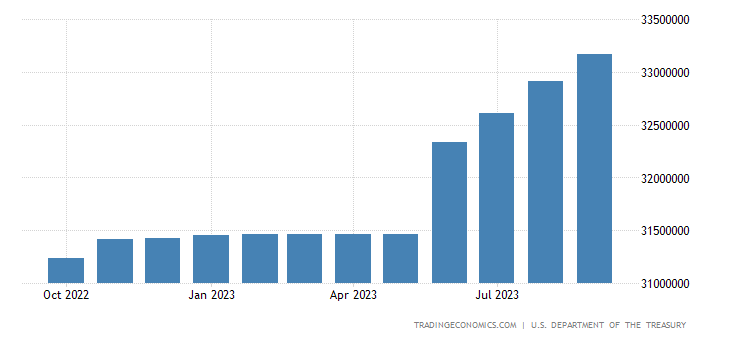

The idea of US debt as a Ponzi scheme was outlined in an article by Thorsten Polleit and published by the Mises Institute on its website. The main point of this article is the big rise in US 10-year bond yields over the summer. Interest rates initially did not respond much to the Fed’s efforts. According to Polleit, America’s debt will reach 50,000 billion in a year. The US Treasury Department estimates that the US government will pay a total of $1.05 trillion to service its national debt in 2023. This is $100 billion more than in 2022 and is a new all-time record.

For 2024, the Ministry of Finance estimates that debt servicing costs will reach 1.15 trillion dollars. This means an increase of another 100 billion dollars. Here we already see the outlines of a Ponzi pyramid, as the US will soon start borrowing more and more money. In addition, as debt increases, borrowing costs will also increase.

Evolution of US national debt over the past year:

Why are US bond yields rising?

Polleit sees the main reason for the rise in yields to be the bad US geopolitical situation. Traditional buyers of US bonds are not interested in them. Among the largest buyers of US bonds are Japan, China, Brazil, Russia and Saudi Arabia. Russia can’t even buy US bonds now. Moreover, sanctions against Russia have proven counterproductive. Countries that may be on the USAm sanctions list will write off American bonds. Freezing Russia’s foreign exchange reserves did not lead to the collapse of the Russian economy. All that has been achieved is that Russia and China have become more connected. From an economic point of view, buying government bonds with a public financial deficit of 6% is not a good thing.

What’s next?

According to Polleit, the fight against inflation will end in an economic recession. This will further increase the US government’s concerns because the country’s financial deficit will deepen. Therefore, income must grow even more. The Ponzi scheme will continue until investors stop buying new bonds being issued. At that point, the central bank must take over control of government bond purchases. This means capitulation in the fight against inflation. Leaving the Ponzi pyramid is not easy and is always very painful. I personally believe that we are constantly just buying time to delay the debt problem. Even high inflation in previous months did not help these countries reduce their debt. Sadly.

Matej Shiroky

“Tv nerd. Passionate food specialist. Travel practitioner. Web guru. Hardcore zombieaholic. Unapologetic music fanatic.”